VAT fraud - a profitable business - £400 Mn a month ..ish

Missing Trader Intra-Community (MTIC), or 'missing trader' fraud , is a highly sophisticated and organised criminal attack on the UK VAT system. It is an EU-wide scam, estimated to have cost the UK government between £1.12billion and £1.9 billion in 2004/05. The sums being lost are so huge they have been distorting the country's trade statistics and income - UK VAT revenues fell last year, the first time since its introduction 1973. The Torygraph report that the Inland Revenue's £1.155 billion slice of £6.6 billion of imports, out of a total £45.7 billion worth of EU imports, has been lost over the first quarter of 2006. The annual loss will be £4.6 Bn in 2006 if it continues unabated. The Office of National Statistics announced last month that such fraud fell by £500m to £1.2bn between July and August.

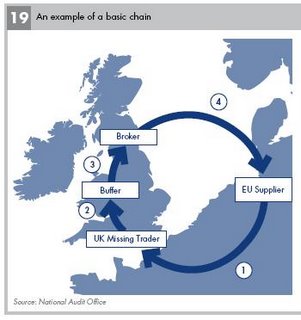

Criminals import compact , high value goods such as mobile phones and computer chips, free of VAT, from other countries in the European Union. The goods are sold on with VAT in the UK , but the criminals disappear with the tax they have collected instead of handing it over to the tax collectors, HMRC. Newer variations involved extra EU nations especially Switzerland. There has been some success against one operation .....

Avantis Trading Ltd, Diamond Traders International Limited and Sovereign Imports Limited were connected companies based in Birmngham which turned over a staggering £185 million in 7 months.

They operated a complex and sophisticated scam that was unravelled by officers from HM Revenue & Customs (HMRC) and has involved 3 separate trials:

Trial 1.

In April 2006, Asad Chohan and Saajid Chohan were found guilty of evading excise duty of £750,000 under the Customs and Excise Management Act 1979 following the seizure of 2.4 tonnes of hand rolling tobacco at Dover Eastern Docks on 17 August 2000.

Asad Hussain Chohan, (38) of Wake Green Road, Birmingham, was sentenced to four years in prison in April 2006 and one year consecutive, for absconding during the trial. He is believed to be in Pakistan. He will face trial in relation to the 'missing trader' fraud and money laundering activities when (and if) re-arrested.

His younger brother , Saajid Chohan (33) of Wake Green Road Birmingham, was sentenced to 18 months in prison

Trial 2

In July 2006, Saajid Hussain Chohan (33) and Mohammed Ilyas pleaded guilty to cheating the public revenue of £5.17million in a 'missing trader' fraud. Saajid Chohan (33) was sentenced to a further four years in prison for the 'missing trader' fraud in July 2006. A Confiscation Order of £120,318 was also made and a further two years will be added to his sentence if he defaults on the Order.

Mohammed Ilyas, (46) of Bagnell Road, Birmingham, was sentenced to three years in prison .

Trial 3 Concluded on Wednesday 15 November 2006 in Birmingham Crown Court , Samiah Ali Chohan (34) and wife of Asad, was found guilty of a money laundering offence under the Criminal Justice Act 1988, through the purchase of a property, valued at around £380,000. She gave a previous address of Wake Green Road, Birmingham, and now of "Lauriston", Manchester Road, Rochdale, and was sentenced to a Community Service Order of 80 hours.Pic shows, bijou, compact 10 bedroom Victorian textile magnates mansion, "Lauriston", Manchester Road, Rochdale.

Concluded on Wednesday 15 November 2006 in Birmingham Crown Court , Samiah Ali Chohan (34) and wife of Asad, was found guilty of a money laundering offence under the Criminal Justice Act 1988, through the purchase of a property, valued at around £380,000. She gave a previous address of Wake Green Road, Birmingham, and now of "Lauriston", Manchester Road, Rochdale, and was sentenced to a Community Service Order of 80 hours.Pic shows, bijou, compact 10 bedroom Victorian textile magnates mansion, "Lauriston", Manchester Road, Rochdale.

The court heard that the organised crime group was controlled by Asad Chohan and included his brother Saajid Chohan, his wife Samiah Ali Chohan and Mohammed Ilyas, the family bookkeeper and a member of the Institute of Accounting Technicians.

Chris Ballard, assistant chief investigation Officer for Revenue & Customs said:

"This was not some kind of advanced tax planning, but organised fraud on a massive scale perpetrated by criminals.

"They had the active co-operation of professionals in the legal and accountancy sectors, all bent on making fast and easy profits at the expense of the British taxpayer."

Investigations into the Chohan frauds led to a separate, investigation which identified over £200 million of 'missing trader' money being laundered through a firm of solicitors, Beveridge Gauntlet of Fleet, Hampshire.

The firm had been launched a year earlier with an overdraft teamed up with "dodgy clients" transforming its "sacrosanct" client account into a bank, it was claimed in court. 7 sham companies were able to launder £250 million between May 2002 and March 2003 through the firm's client bank account. The use of the solicitors' client account gave the fraud an air of legitimacy.

The company's Legal Executive Laurence Ford (56), twice divorced father of two children, was sentenced to 6 years in prison in June 2006 at Southwark Crown Court for money laundering offences contrary to Section 93C of the Criminal Justice Act 1988. he is said to have been paid £40,000 for his work.

The company's Legal Executive Laurence Ford (56), twice divorced father of two children, was sentenced to 6 years in prison in June 2006 at Southwark Crown Court for money laundering offences contrary to Section 93C of the Criminal Justice Act 1988. he is said to have been paid £40,000 for his work.The partners of the firm Matthew Gauntlett ( Law Society Council member) and Sarah Beveridge were found not guilty at the trial (the first time solicitors had been charged with such offences), and Mr Justice Rivlin said , " ...(they) were acquitted [because] the jury accepted their case that on any view they were both wholly unsuited to the responsibilities of running a practice on their own. That not merely were they inexperienced, (MG was a Law Society Council member- for Christ sakes !!) but they were quite out of their depth, neither having the strength of personality to run a firm themselves. They were woefully [unable to] fulfil the responsibility expected of partners.’

It must have cheered up the HMC when Elizabeth Robinson, of Peters & Peters, the lawyer representing Sarah Beveridge was made Lawyer of the Week by The Times on June 13, 2006. She had been working on this case for three years and the barristers involved, Andrew Radcliffe, QC, and Tom Forster, for two years. The costs for the "out of depth" lawyers defence in the 6 weeek trial would make your eyes water. - and would be paid by HMC.

Beveridge Gauntlett, was closed down by the Law Society three years ago. Their rather grand address of "Rosebank Chambers " was in fact a first floor office above an off-licence and estate agent, in an ordinary shopping parade in the village of Yateley, near Aldershot in Hampshire.

Having locked up Ford, (which took over 3 years) HM Customs officers have yet to find the ringleaders. A senior partner at accountants Grant Thornton, said: "This guy is the tip of the iceberg. Government attempts to crackdown on this type of fraud seem to be having no effect whatsoever."

On Wednesday 15 September 2006 HM Customs issued HMRC Business Brief 14/06 with dertails of what is called Reverse Charge Accounting for traders in Mobile phones, computer chips, electronic storage meda (memory cards) for MP3 players,palm computers, GSP driven Sat Nav systems and electronic game consoles which they expected to introduce on December 1st 2006. On the 10th November they announced a delay (Because EU discussions about the necessary derogation are still continuing ?) and stated they would give traders 8 weeks notice when it was introduced.

Reverse Charge accounting changes the responsibility for VAT payment to the purchaser, rather than the seller - subject of course to all sorts of conditions - small transactions etc.,

It is hoped that this change in accounting will eliminate the fraud. Don't hold your breath.

No comments:

Post a Comment